Net worth update: January 2022

- themoneyloaf

- Feb 9, 2022

- 2 min read

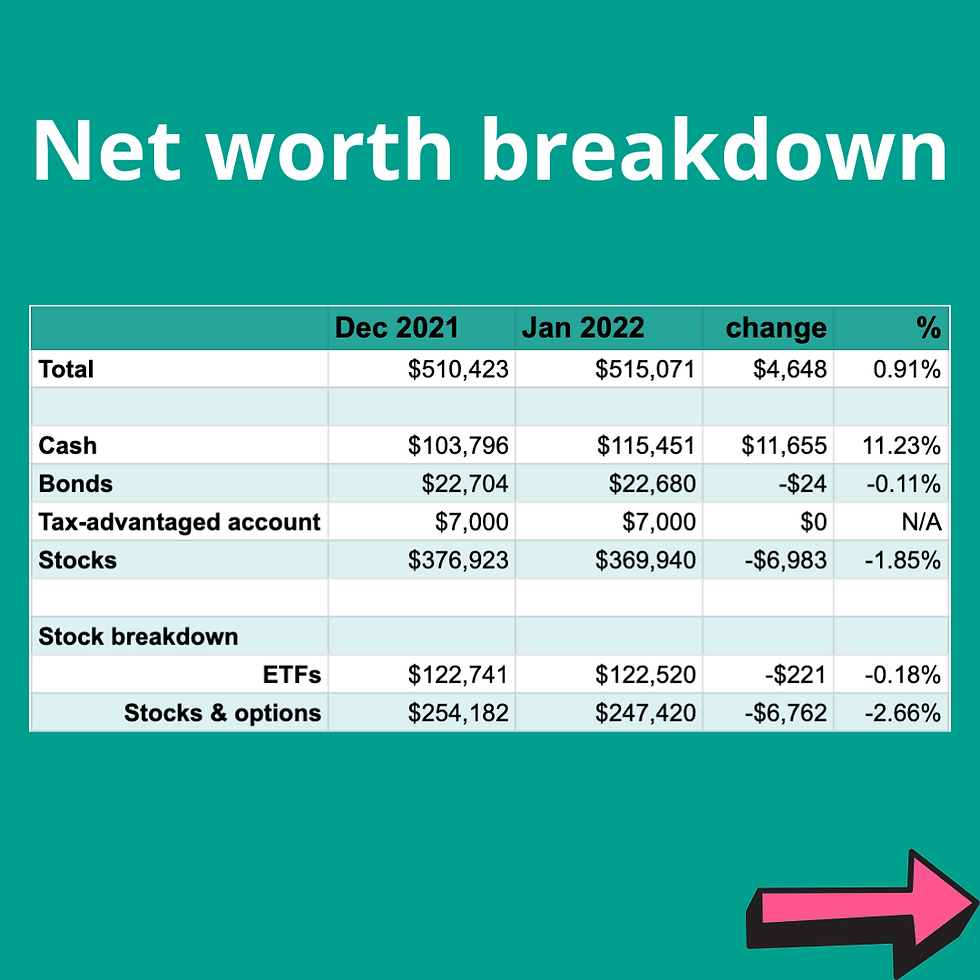

January was a pretty volatile in the markets, which was good for my options positions, but bad for any stock positions. I fully expected to be down for the month of January, and the only reason our net worth increased this month is because of a technicality.

I invested some money in an acquaintance's business many years ago and it didn't work out, but he promised to pay me back. Well, this month he paid me back, which is about $5,000 out of the increased cash portion. Without that cash injection, it would have been a down month.

Nothing much to say this month except to point out the huge variance in volatility of ETFs vs individual stocks.

The ETF portion is down -0.18%, while the stock portfolio is down -2.66%. In other words, the stock portfolio was nearly 15x more volatile compared to the ETF. If volatility will keep you awake at night, broad-market ETFs are the way to go.

On the asset allocation front, that cash portion is growing above 20% again, which is not ideal. We do have a plan to invest the money, just that we've been procrastinating on opening up a joint account to buy ETFs. The reason for the joint account is really to make it easier for the surviving person to withdraw money, in the event something happens to either one of us (hopefully not for many years).

ps: Because our property and retirement accounts are excluded, I realise maybe I should label these our "FI assets" instead of net worth - but again I think for simplicity I'll leave it as it is and put this line for transparency.

Comments